Units of Production Method may be appropriate where there is a high correlation between activity of an asset and its physical wear and tear. The estimated serviceable life of the generator is expected to be 5,000 hours. The generator is projected to have a scrap value of $50,000 at the end of its serviceable life. In the units of production or units of output are alternative terms for the current accounting period, the generator ran for approximately 300 hours. It’s also referred to as a non-cash expense because the cash used to buy the asset left the company when it was purchased.

- The process of systematic allocation of an asset’s value over its’s useful life is called depreciation.

- Now you’ve to find the depreciation of the machine according to the unit of production method.

- When a company purchases an asset like a delivery truck, it must account for depreciation, which reflects the asset’s usage over time.

- Understanding the unit of production is also essential for cost analysis and pricing strategies.

- The skid-steer is expected to be rented for 5,000 operating hours over its useful life.

- Maintaining proper records is essential to comply with IRS guidelines.

Benefits of Unit-of-Production Depreciation

So there is little room for error when accounting for the depreciation expense. California State University, Northridge notes that different depreciation methods, including the MACRS and double-declining balance, make more sense for different assets and tax purposes, depending on IRS rules. For example, a factory robot is more likely to experience wear and tear as it produces hubcaps than a piece of software as it produces spreadsheets. The unit of production depreciation method is primarily used for assets that are prone to wear and tear to a higher degree. Therefore, it allows companies to report higher depreciation in highly productive years which can be offset by reporting lesser during the off-season. The units-of-output depreciation method is based on the assumption an asset will produce a fixed number of units over its lifetime.

Chapter 9: Property, Plant, and Equipment

If the asset is rarely used, its depreciation will be lesser and an asset will have greater depreciation for years when it is heavily used. The term units-of-output depreciation refers to one of several methods of allocating the cost of an asset over its expected lifetime. The units of production depreciation method assumes that actual use, rather than the passage of time, is what determines how an asset depreciates. Rather than depreciating over a number of years, the asset depreciates after it’s been used a certain number of times, referred to as units of production. The Corporate Finance Institute explains that the straight-line depreciation method is simple to calculate because it allocates the same depreciation expense for each accounting period.

Is the Unit-of-Production Depreciation Right for Your Business?

The unit of production depreciation method applies to manufacturing assets where idle time is less and production is efficient. Nowadays, this method is more popular in determining the efficiency of an asset. The Unit-of-Production Method offers more accuracy than other depreciation methods. However, tracking production data can be complex and time-consuming. If asset usage is consistent, the results may not differ much from straight-line depreciation, making the extra effort unnecessary.

- The Unit-of-Production (or “Units of Production”) Depreciation Method ties equipment’s loss of value to how much it is used, making it more accurate for certain businesses.

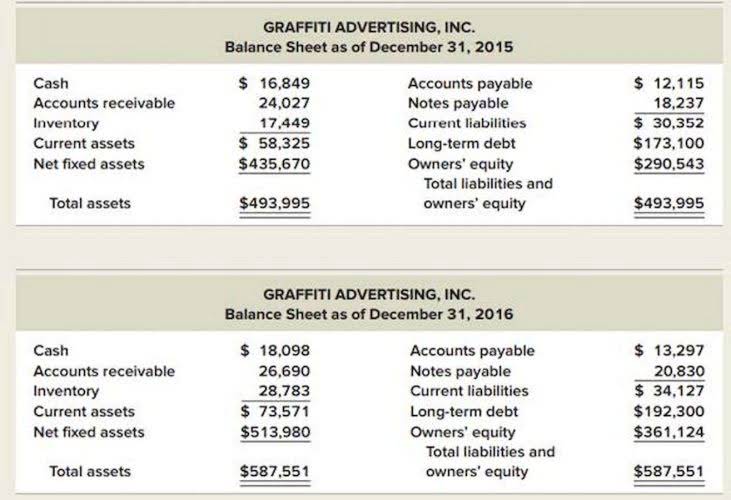

- Current assets are short-term liquid assets that can be converted into cash easily.

- It benefits businesses with fluctuating production levels, offering greater tax efficiency and financial accuracy.

- A toy manufacturing company in Jacksonville, Florida, purchases a machine for $300,000.

- Since this method of depreciation is based on physical output, firms apply it in situations where usage rather than obsolescence leads to the demise of the asset.

- It is done by estimating the output from the asset over the useful life.

- The Unit-of-Production Depreciation Method ties depreciation directly to how much an asset is used.

- The straight-line method and unit of production method are two ways to compute how a fixed asset depreciates, or loses value, over a period of time.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Get instant access to video lessons taught by experienced investment bankers.

- However, MACRS did not accurately track losses and profits that an asset generate over time like the unit of production method.

- The cost accountants at West believe the salvage value of the machine is $20,000 and the machine will produce 20,000 units during its useful life.

- An average cost per unit is applied to the total units produced by the machine or plant in a financial period to determine depreciation under the unit of production method.

Due to the poor results, the stocks in this sector plummeted and the energy sector was placed last on S&P500. In fact, oil and gas companies reported a staggering $280 billion in negative free cash flow from 2007 Accounts Receivable Outsourcing to 2017. Plastic LTD purchases a steel mould costing $1 million to be used in the production of plastic glasses.

What Does the Unit of Production Method Tell You?

It helps businesses better manage costs income summary and avoid overestimating asset values. The cost accountants at West believe the salvage value of the machine is $20,000 and the machine will produce 20,000 units during its useful life. The formula to calculate the depreciation expense under the units of production method is as follows.